Complete Guide to Eyecare Payment Options

Vision correction procedures such as LASIK, Photorefractive Keratectomy (PRK), Implantable Collamer Lens (ICL), and Clear Lens Exchange (CLE) can be important for obtaining and maintaining optimal eye health. At ICON Eyecare, we believe that high-quality eye and vision care should be accessible and available to everyone. That’s why we strive to help make vision correction affordable and helping patients understand all their options when it comes covering the cost of high-quality eyecare.

Our knowledgeable staff is experienced in working with insurance plans, financing options, flexible spending accounts and health spending accounts, flex dollars, and tax refunds.

1. Insurance

![]()

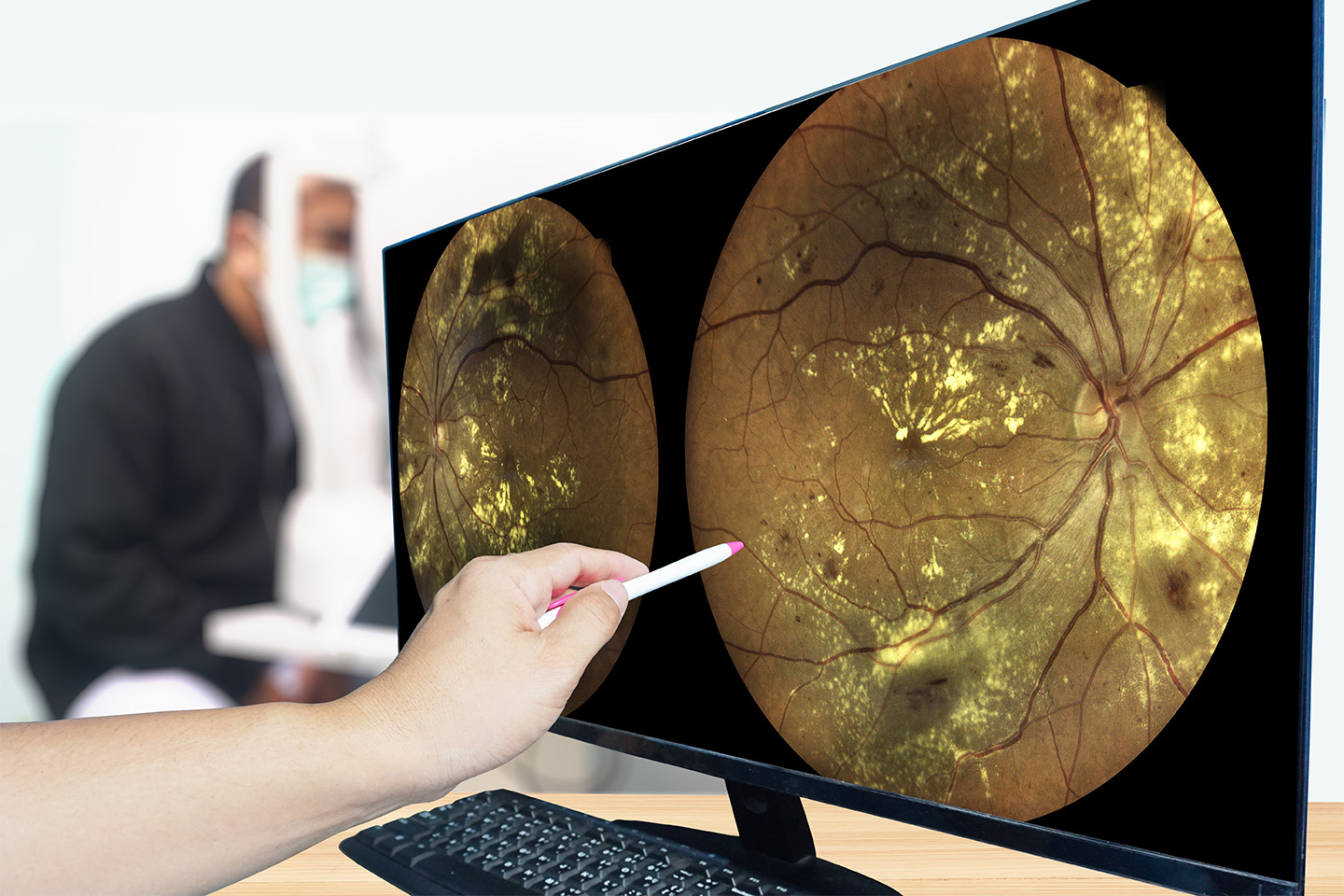

At ICON Eyecare, we work with a long list of insurance providers so you can receive the eyecare you need, when you need it. We strive to provide convenience for our patients by submitting the claims to your insurance company on your behalf. That way, you can focus on what’s truly important, your eye health.

We can also help you with understanding your insurance coverage, specifically, whether you will receive partial or complete coverage. In most cases, insurance companies will provide coverage for basic vision-related costs. However, vision coverage can be limited, and you may be responsible for co-payment or deductibles. It can be beneficial to know of any out-of-pocket costs beforehand. You can often find out this information by referring to your insurance policy details or by speaking with an insurance customer service agent.

Many insurance providers view vision correction procedures like LASIK, PRK, and ICL as elective, but recently more insurance companies have begun to cover vision correction procedures so be sure to check with your vision insurance company to see what be covered through your plan.

You may also be eligible for correction procedure coverage from your health insurance if certain criteria are met. Examples may include refractive errors resulting from injury or surgery that cause extensive impairment to your vision, or if you cannot wear glasses or contacts due to medical or physical limitations.

2. Financing

![]()

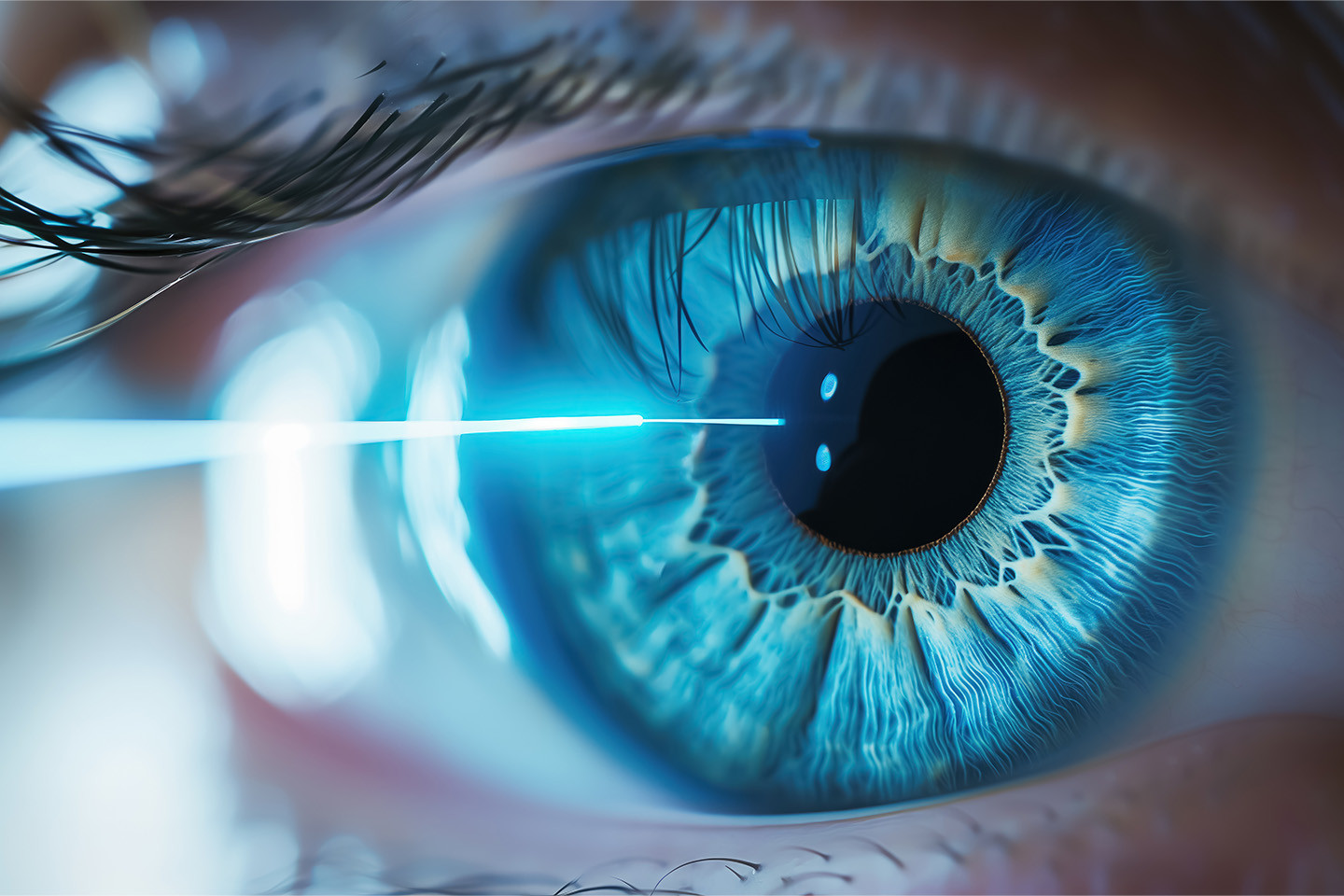

Our staff understands that costs can be a deterrent to receiving a certain vision care procedure or vision surgery that is necessary for the clearest vision, eye health, and quality of life. Treatment costs and procedure prices should never stand in the way of receiving optimal care. At ICON Eyecare, we provide exceptional financing options through ALPHAEON Credit and CareCredit with approved credit. Both ALPHAEON and CareCredit offer 0% interest payment plans for up to 24 months with no deposit necessary.

Financing can allow you to spread the total cost of your vision correction procedure over a specified period, with extended payment options up to five years. This way, you can make monthly installment payments that are more affordable or convenient for you. If you would like to learn more about a financing plan that will work for you, our friendly staff will take care of your questions and help with the application process during your consultation.

3. Flexible Spending Account

![]()

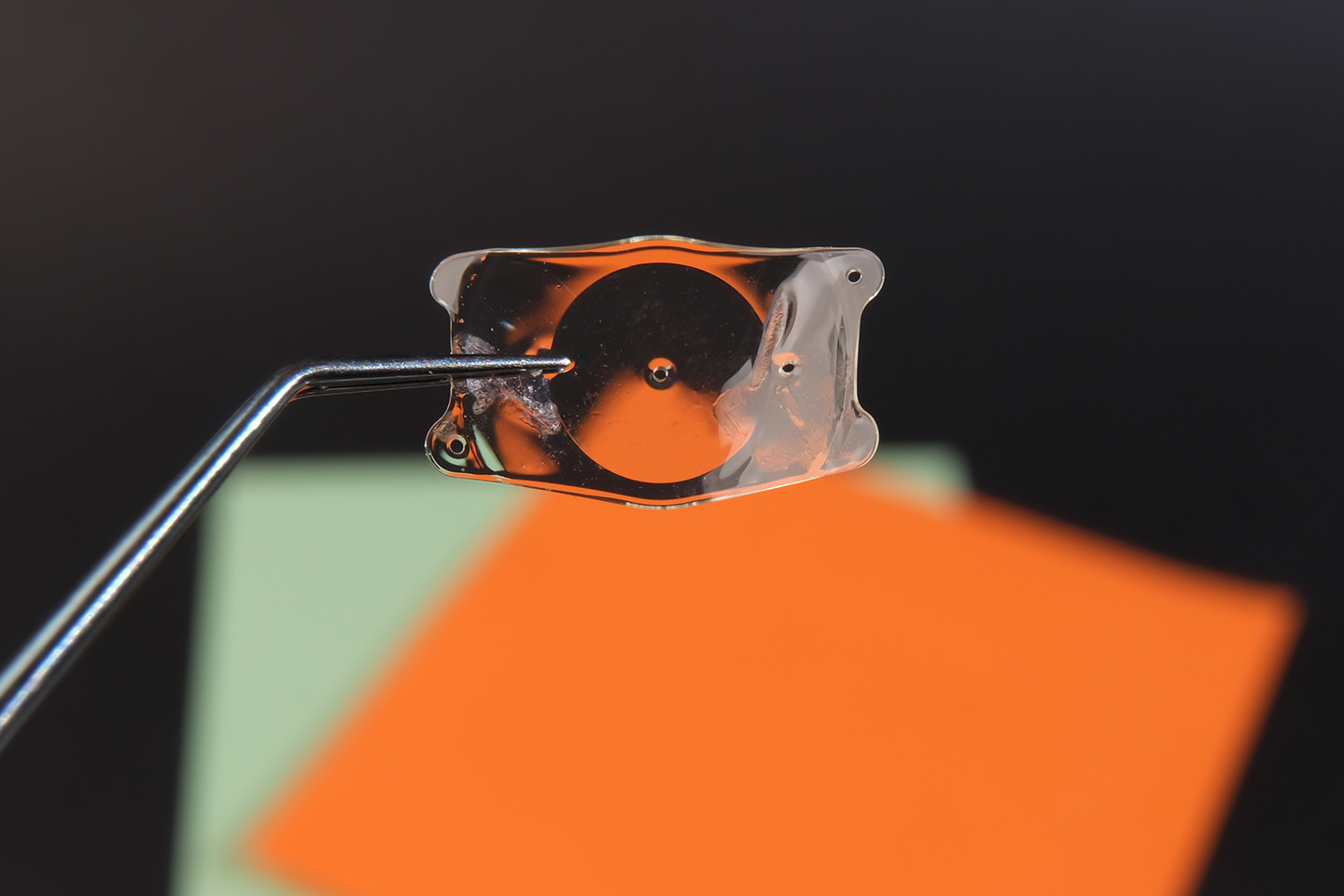

An alternative payment plan that you may have access to is a Flexible Spending Account (FSA) typically offered through your employer. An FSA is an insurance saving plan that allows you to save money in the current year to pay for medical expenses, such as vision corrective surgery. It can be used alongside other payments, such as your health insurance, to offset out-of-pocket costs.

A benefits administrator at your place of work can advise you on eligibility for an FSA and the benefits of maintaining one. Your employer will then withdraw a certain, pre-arranged portion of each paycheck, prior to tax deductions, to place into your FSA.

You can utilize a quote from your dedicated vision care provider, ICON Eyecare in the Denver metro area, to plan and fund your FSA during the enrollment period. When your FSA becomes available, you can then use your pre-planned funds cover all or part of your vision correction procedure. Alternatively, if you are already set up with an FSA to cover medical, dental and vision costs, you may be able to utilize your current funds to pay for your vision correction surgery. It is important to use your balance before the end of the year since most of your FSA balance will not carry over into the next year.

To complete the payment with an FSA, you can use your FSA debit card to pay the amount in full or partial amounts. If you do not have an FSA card, you can submit your receipt and a statement indicating the coverage amount from your health or vision insurance provider, and the FSA program will refund the payment from your balance.

4. Health Savings Account

![]()

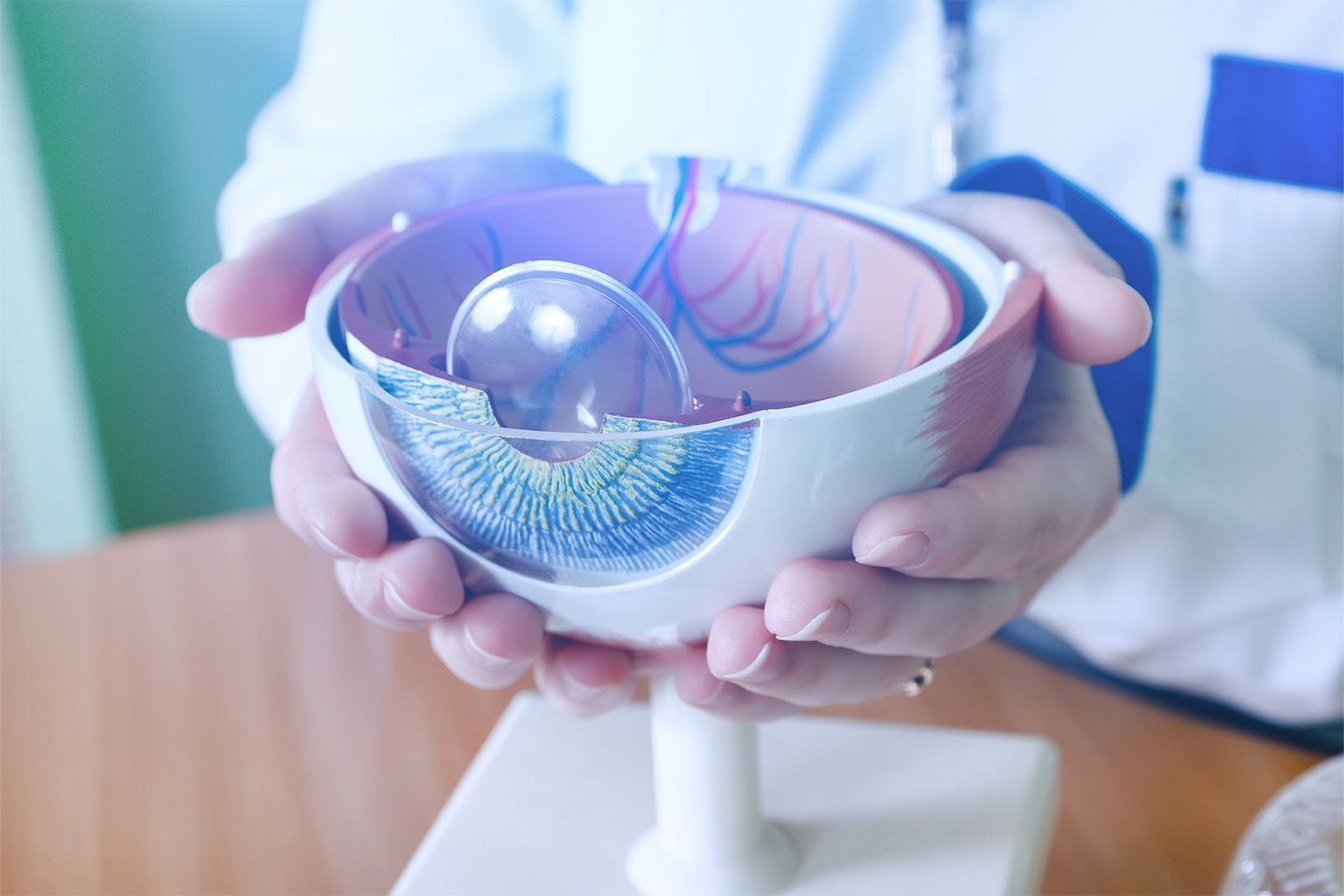

A Health Savings Account is an excellent payment option for certain patients to offset the out-of-pocket costs that their insurance companies do not cover. An HSA can help individuals who have insurance plans with high deductibles. It is also designed for individuals who could benefit from having an amount placed safely aside for medical, dental, and vision expenses as they arise.

Unlike an FSA, you do not need to set up an HSA through your employer, which can make it an accessible option or a supplemental option for those with health insurance. An HSA can be opened at most major banks although you will still benefit from pre-tax savings, like an FSA. Additionally, your funds roll over to the next year indefinitely, such that you do not necessarily plan to have a particular amount in your account each year to cover your procedure. However, you may still wish to do so if you are interested in the most affordable payment plan.

If you have already set up and contributed to an HSA, you can utilize the appropriate amount to pay for your vision correction procedure. You can use your HSA debit card to pay the amount in full or the partial amount that your health insurance has not covered. If you do not have an HSA card, you can be reimbursed from your HSA.

5. Flex Dollars

![]()

At ICON Eyecare, we want to ensure that you have access to the most convenient payment option available to cover your vision corrective procedure. Our staff will also accept flex dollars as a form of payment for a full-coverage option or alongside other forms of payment, such as health insurance. Flex Dollars or Flex Credits are part of flexible benefit plans that may be available to you through your academic institution or your employer.

If your institution or company provides Flex Dollars, they may issue a certain electronic amount or allot a certain amount towards a Flexible Spending Account. You are free to use the available balance as you see fit throughout the course of the year to cover medical, dental, or vision expenses. In this way, you can take advantage of the total amount to pay off your vision corrective surgery or you can use it throughout the year along with a financing payment plan. As you use a portion of the amount, your balance will go down.

As Flex Dollars are typically included in a Flexible Spending Account, you can use your FSA debit card to fully or partially pay your total amount. You can also submit a receipt and a statement indicating the coverage amount from your health or vision insurance provider, and the FSA program will refund your payment from your FSA balance.

6. Tax Refunds

![]()

Another option is to use your Tax Refund for vision correction surgery! Once you get your tax refund, you can take those funds and put it toward the cost of your procedure. What better way to spend that money that giving yourself the gift of better sight!

Schedule a LASIK consultation with ICON Eyecare to get a complete quote and understanding of the vision correction procedure that’s right for you. Once you’ve got that tax refund, schedule surgery and use that check to offset the costs.

Do not hesitate to reach out to our team at ICON Eyecare. We want to make it as easy as possible to support your vision health with a multitude of payment options.

[DISPLAY_ULTIMATE_SOCIAL_ICONS]