How to Use Your HSA for Vision Correction Surgery

![]()

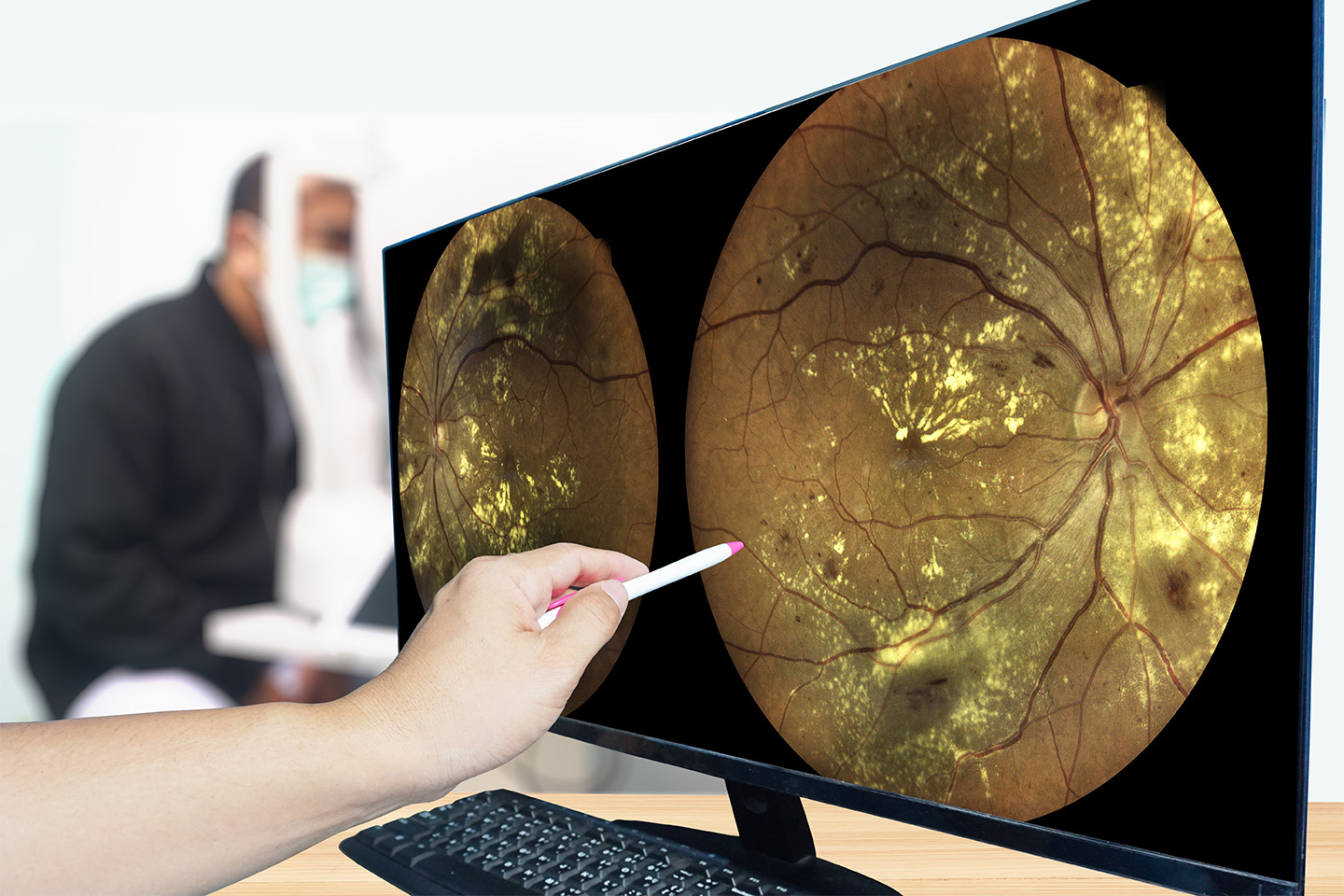

Have you been planning on getting LASIK surgery or another type of vision correction surgery? You know that not only will you see better without glasses or contacts, but you’ll be also able to save on the cost of those devices over the years to come. That makes LASIK and similar vision correction procedures an even better investment. Another way to balance your accounts when choosing LASIK is using your IRS-defined healthcare expense benefits, including your HSA if you have one.

Your Healthcare Savings Account helps you manage your medical expenses as allowed by IRS rules, including some laser vision correction procedures. At ICON Eyecare, our eye doctors in the Front Range provide expert vision correction surgery, including LASIK. Our patient care team can help you use your HSA funds effectively to meet your vision care goals.

What is an HSA?

An HSA, or Health Savings Account, is a bank account containing pretax dollars that you’ve contributed to according to IRS rules. It’s only available to individuals and families who have high deductible health insurance plans. Unlike employer-provided FSA or Flexible Spending Accounts that can also be used for eyecare, the HSA account can build up over time and doesn’t expire annually. If you have been contributing already, it can be a boost to help you meet your vision correction goals, and if you haven’t, you can see how saving and even investing pretax dollars in an HSA can help you meet those goals.

Why an HSA is Helpful for Your Finances

The funds in your HSA go further because they are pretax dollars, making it easier to afford the cost of LASIK and other laser vision correction procedures. They also help you prepare for your vision care goals, setting aside funds without expiration. An HSA account stays with you, even if you change jobs, and builds up over time rather than expiring as FSA funds do. You can even invest your HSA funds to help them go even further.

HSA vs. FSA, and Can You Use Both for LASIK?

An FSA is part of your employer’s benefits that you can tap for qualified expenses, such as vision care and laser vision correction surgery. HSA accounts also allow you to use funds for vision correction surgery and can be used to save up for procedures over time. HSAs are specifically meant for those with high deductible health plans. For those with HSAs, a limited-purpose FSA is sometimes available to use for specific medical expenses which typically includes vision care, providing two pretax ways to pay for your vision correction surgery.

How to Use Your HSA for Vision Correction Surgery

The first step of using your HSA funds to pay for your vision correction surgery is to find out if you’re a candidate and learn which vision correction procedure is right for you. ICON Eyecare offers LASIK, PRK, Visian ICL, and Clear Lens Exchange. During your free consultation, our team of eye doctors will talk with you about what’s best for your vision and explain the costs of your chosen surgical treatment.

After you know which vision correction procedure is right for you, it’s time to start planning your HSA contributions. Since HSA funds can be contributed at any time and roll over annually, you can plan for vision correction surgery as soon as you’d like.

If you already have HSA funds that you’d like you use, you can book your surgery for as soon as you’d like. You can use your HSA funds immediately and then finance the rest of your vision correction procedure. ICON offers 0% financing for 24 months! Another option is to wait until you have the proper amount of HSA funds to help offset the costs of your procedure and then book your surgery – the choice is yours!

On surgery day, you can use those HSA funds. The key to keeping the funds tax-free is to keep your receipts as documentation that the funds were used for covered expenses.

Our Patient Care Team Can Help Your with Vision Correction Surgery

At ICON Eyecare, our eye doctors in the Front Range work with an excellent patient care team who helps to answer your questions about eyecare, procedures, and finances. We know a lot about resources like HSA and FSA accounts, as well as employer insurance coverage, employer-based discounts, and other provisions that can help reduce the cost of LASIK and other laser vision correction procedures. We have many options to improve your vision, so make an appointment today to find out how you can reach your vision goals!

[DISPLAY_ULTIMATE_SOCIAL_ICONS]