How to Use Your FSA for Vision Correction Surgery

![]()

Is LASIK on your wish list so that you won’t need to wear glasses or contacts all the time? Better vision is goal, but you’ll also save money on prescription glasses and contacts in the decades ahead. For patients covered by an employer’s FSA, or Flexible Spending Account, you have another resource to help make LASIK and other eye surgeries more affordable. At ICON Eyecare, our eye doctors in the Front Range are some of the top providers of LASIK surgery, PRK, and other laser vision correction procedures. We can help make vision correction surgery possible with a financial strategy that includes your FSA account.

How an FSA Helps You Meet Your Medical Expenses

An FSA provides a way to use pretax dollars to pay for medical expenses, making your money go further by a significant amount, and reducing your tax bill. Even if you use an HSA instead for your pretax healthcare contributions, a limited purpose FSA may be available that often provides vision care benefits.

Contribution Limits and Rollover Options

With FSA accounts, the funds typically need to be spent in the current year, or during an optional grace period of up to two-and-a-half months, if implemented. If there’s a rollover feature in the plan, that allows up to $500 to roll over into the next year, without counting against that year’s contribution limit. Because your funds must be spent within a year, it’s important to plan ahead to get the most out of our FSA.

FSA vs. HSA

An FSA is an employer benefit that can be used for qualified expenses. An HSA is a benefit that allows you to save funds each year to pay for medical expenses. HSAs are meant for those who have high-deductible health plans. An FSA is lost if you change jobs or don’t spend the money within the specific period. HSAs are your funds and can be carried with you to another job or even invested.

Do FSA Funds Expire if You Don’t Use Them? Can You Use Them Before You Contribute?

Yes, although the rules are different during 2021, allowing larger rollovers if your plan allows them. Typically, funds expire at the end of the year or during an optional two-and-a-half month grace period after that, but in 2021 that is extended to 12 months. FSA funds are available immediately when you open your plan, so you can use them any time during the year. During any grace period, you’ll have the funds for the previous and current year available together.

Which Vision Correction Surgeries are Covered by FSA Rules?

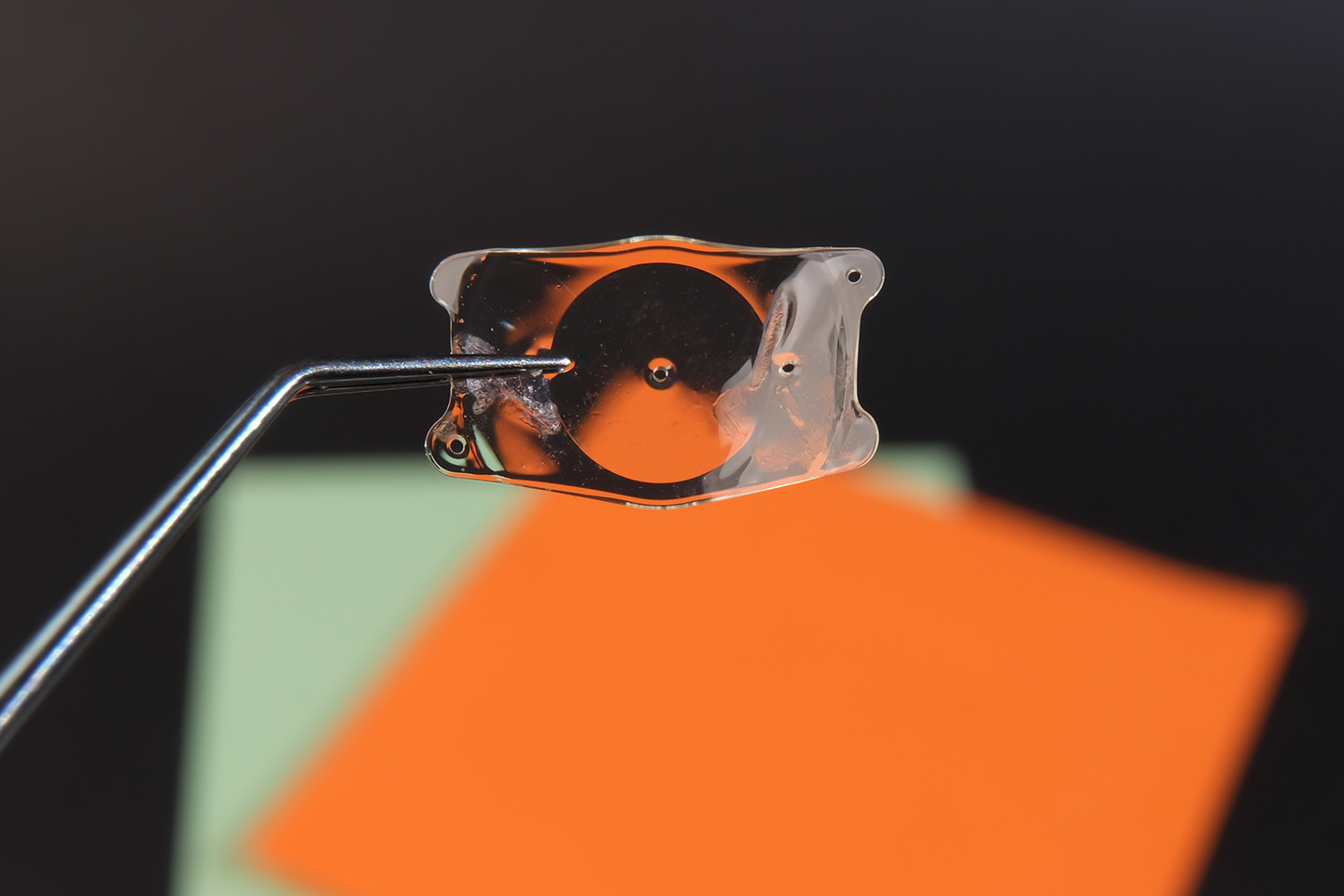

LASIK, PRK, ICL, and Clear Lens Exchange can be funded at least in part by your FSA account.

How Do You Use FSA Funds to Pay for Vision Correction Surgery?

The first step in using your FSA funds to pay for vision correction surgery is to find out if you’re a candidate and learn which vision correction procedure is right for you. During your free consultation, our team of eye doctors will talk with you about what’s best for your vision and discuss the costs of your chosen surgical treatment in a personalized quote.

Based on the quote, you can plan your FSA contributions for the following year to be sure you have the appropriate funds to pay for all or part of your vision correction surgery. Since your FSA is funded during the open enrollment period, it’s important to know how much you’ll need to set aside.

Since FSA funds are accessible at the beginning of your new plan year you can schedule your surgery as soon as you’d like after your FSA funds become available.

After your surgery, your employer will handle your FSA claim for reimbursement, which will include proof of the medical expense and a statement that it wasn’t covered by your health plan. The FSA plan will then issue a reimbursement to you.

Our Patient Care Team Can Help Combine Your FSA with Other Resources to Meet Your Vision Goals

At ICON Eyecare, we can help you make your vision correction goals happen. Our eye doctors in the Front Range provide excellence in vision care, and our patient care team will answer all your questions about eyecare, procedures, and financing options. We can help you find and combine resources to meet your goals, including your HSA or FSA account, your employer’s insurance plan, employer-based discounts, and other resources. Make an appointment today to achieve your vision goals!

[DISPLAY_ULTIMATE_SOCIAL_ICONS]