FSA for Eye Health

December is a special month – a time to reflect on the year past and look forward to the one ahead. One of your priorities should be to consider your eye health and vision. You can take advantage of specific healthcare benefit plans, such as your Flexible Savings Account (FSA), to cover important eye care exams, treatments, and vision corrections. This way, you can head into 2023 with clear and sharp eyesight.

At ICON Eyecare, our team helps you access affordable vision treatments and surgeries. We offer a range of payment options, including an FSA. If you have this plan, you must use it before the end of the year (or otherwise specified term end date). So, it is important to receive your care before the 31st.

What Is a Flexible Savings Account (FSA)?

A Flexible Savings Account (FSA) is a fund to offset healthcare and medical expenses. Your employer may offer an FSA, allowing you to deduct a specific amount, pre-tax, per paycheck and place it into an account. In 2022, employees could contribute up to $3,050 to their FSA. You must use any FSA balance before the end of the year unless your employer offers a grace period. After this date, you lose all or most of your benefits. Depending on your workplace, you may be able to roll over up to $610 into your 2023 savings.

An FSA is an excellent way to pay for healthcare costs. Once you determine your contributions for the year, you can dip into the total amount even before you accumulate it. Likewise, since it comes out of your paycheck before any tax deductions, it also reduces your income taxes. These advantages make an FSA an ideal option for many patients.

Suppose you contributed a specific amount to your FSA this year. You still have time to utilize the amount for eye care or vision correction surgeries. Alternatively, you may like to opt into FSA for 2023. In that case, you may request a quote for a particular procedure and start planning the year ahead. You may even combine the full amount with any applicable rollover.

How to Use Your FSA Benefits

![]()

Interested in setting up and using FSA benefits? It is easy when you know the steps!

- Talk to Your Employer about an FSA: You can only set up an FSA if your employer offers the program. Contact your Human Resources (HR) department to learn more about your benefits.

- Obtain a Quote: At ICON Eyecare, we tailor our procedures to your specific needs and preferences. Accordingly, the total cost will reflect your unique treatment. You will receive a quote during your consultation to help you plan your FSA allocation for the year.

- Plan Your Contributions: Once you decide upon your contributions from each paycheck, you cannot change the amount. Your quote will help you make the appropriate arrangements.

- Book Your Appointment: When your FSA funds become available, be sure to use them before the term ends by booking an appointment ASAP.

- Pay for Your Surgery: You can use an FSA debit card to fully or partially cover your procedure’s costs. You could also submit your FSA claim, proof of any coverage from your \ insurance provider, and your receipt to your employer. After, you will receive a reimbursement for out-of-pocket costs.

Can You Use FSA for Laser Vision Correction?

Laser vision correction is a significant step for many of our patients. The procedures can improve vision, restore vivid colors and contrast, reduce dependence on eyewear, and boost your quality of life. Unfortunately, medicine and health insurance providers consider laser treatments elective. For patients, this means that they pay the entire bill. It may deter them from receiving life-changing treatment and reducing their long-term eye care expenses.

The good news is FSA can cover the cost of laser vision correction, whether you need LASIK, CLE, Cataract Surgery, or Visian ICL. At ICON Eyecare, we can also combine different forms of payment to ensure the procedure remains affordable.

Can You Use FSA for LASIK?

LASIK is a popular vision correction option for nearsightedness, farsightedness, and astigmatism. Courtesy of state-of-the-art laser technology and skilled eye surgeons, it is well-known as safe, precise, and effective. During the procedure, eye doctors use an ultraviolet laser to reshape the corneal curvature of the eye.

Across the United States, LASIK costs an average of $2,200 per eye. However, this number changes based on your eye, health, location, and more. Some insurance providers offer a discount for the procedure, but most consider it entirely elective. Fortunately, FSA can cover LASIK. It provides a way for patients to manage the upfront costs and reduce any out-of-pocket expenses.

Apart from accepting FSA and other benefits, ICON Eyecare offers a competitive LASIK package. We include:

- Free Consultation: Our knowledgeable eye doctors perform a thorough eye exam. We determine if you are a candidate for LASIK and draw up your quote.

- Customized LASIK: We use advanced technology to accurately measure and map your eye. Our surgeons use the detailed maps and lasers to shape your cornea carefully. You receive precise, personalized results.

- Follow-Up Care: You have one year of free follow-up care post-surgery.

- ICON’s Vision Commitment Plan: If you require any enhancement surgeries, we will pay for the cost of the procedures.

Can You Use FSA for CLE?

If you are ineligible for LASIK, there are alternative procedures to correct nearsightedness, farsightedness, and astigmatism. Clear Lens Exchange (CLE) may be viable for many patients, especially those with thin corneas or dry eyes. Our surgeons remove the eye’s natural lens and replace it with an artificial lens. Our eye care professionals select an intraocular lens (IOL) that accommodates the vision condition and any particular needs.

The cost of CLE depends on your eye, the surgical approach, and your chosen IOL. Insurance plans may not cover the cost of CLE; however, there are options to make the procedure more affordable. An FSA is an excellent method.

Can You Use FSA for Cataract Surgery?

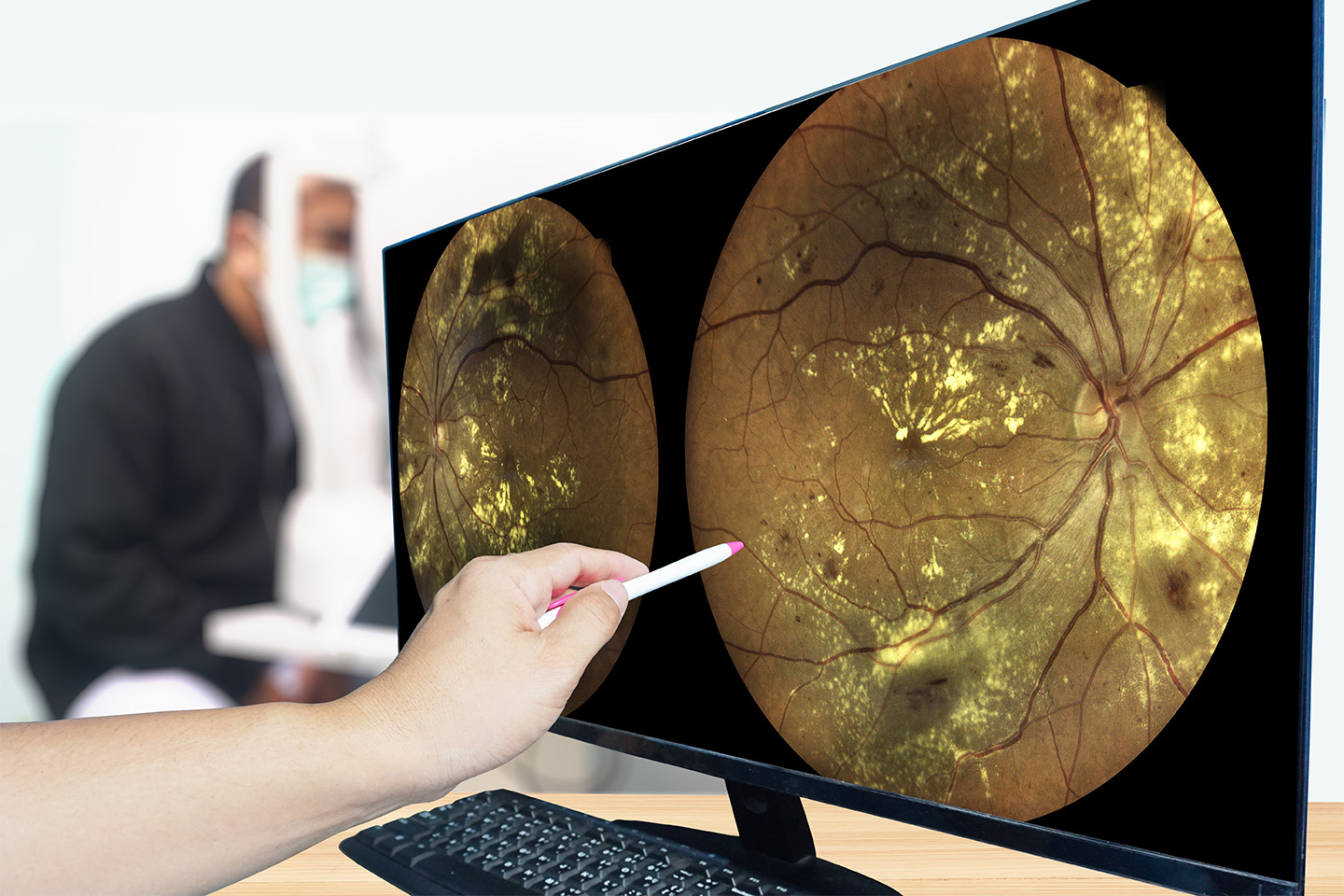

A cataract is an eye condition causing blurry vision, muted colors, and diminished distance and depth perception. As a progressive disease, cataracts can worsen and lead to severe vision loss. It is necessary to receive treatment in the form of cataract surgery. During the procedure, an eye care professional removes the affected, cloudy lens and replaces it with an intraocular lens (IOL). The IOL restores clear vision, razor-sharp focus, and vibrant images.

Since cataract surgery is the only viable treatment for cataracts, Medicare and private health insurance plans typically cover it. However, they may only pay for the traditional approach. The surgeon uses a phacoemulsification tool to break apart the lens and suction out the pieces. They place a basic, monofocal (one distance) lens. Suppose patients wish to proceed with laser cataract surgery or prefer different IOLs. In that case, they may need to pay for these options themselves.

FSA can help pay for any elective parts of the cataract surgery left uncovered by an insurance plan. In this way, those with cataracts can access the care they need.

Can You Use FSA for Visian ICL?

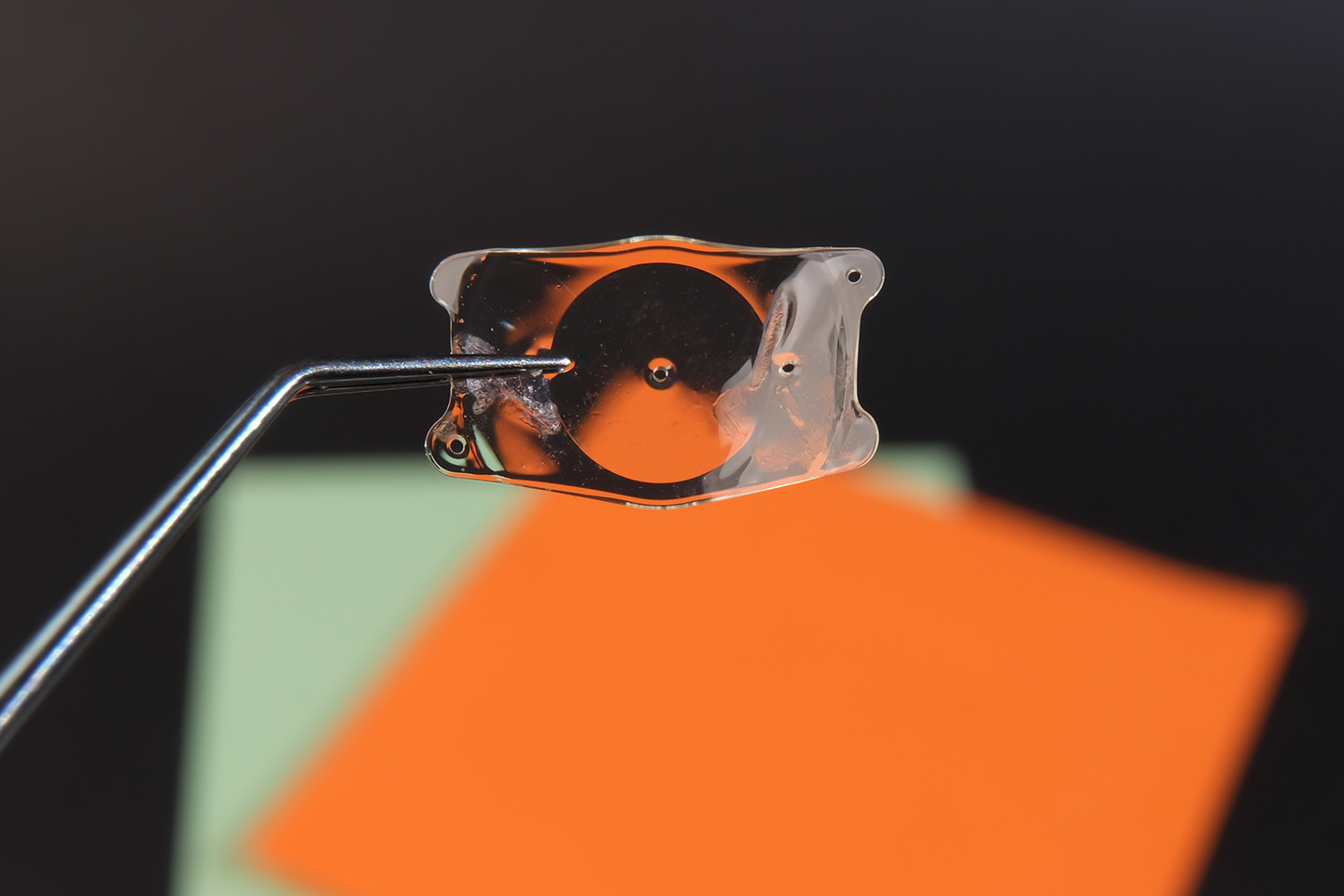

The Visian Implantable Collamer Lens (ICL) surgery involves implanting an artificial lens into the eye. Unlike other vision corrective surgeries, the eye surgeon does not reshape the cornea or remove the eye’s natural lens. Instead, the eye doctor implants a hand-selected, customized lens in front of the eye lens. It corrects nearsightedness and astigmatism.

The Visian ICL is a good option for patients who want to free themselves from glasses or contact lenses. It is similar to a contact lens because it provides immediate vision correction. However, it can stay in the eye permanently. Additional benefits include greater biocompatibility and UV protection.

Most health insurance plans consider Visian ICL an elective or cosmetic procedure. Some providers may provide a discount, similar to LASIK. However, the patient must cover the majority of the costs. Fortunately, FSA can help offset these expenses.

What Does FSA Not Include?

An FSA can help pay for eye exams, prescription eyeglasses and contact lenses, and eye surgeries. However, it is important to know that it only covers some expenses. Before setting up or contributing to an account, you should discuss coverage with your employer.

Common FSA exclusions:

- Non-prescription eyewear and contact lenses

- Specific brands of eyeglasses and contact lenses

- Insurance premiums (it can reimburse deductibles and copayments)

- Any payments coupled with a Marketplace plan (you may look into a Health Savings Account or HSA to offset these costs)

- Costs covered by another plan

ICON Eyecare understands that FSA can have limitations through the specified IRS guidelines and your employer’s discernment. We know that extra expenses can be challenging, so we offer multiple payment methods. We accept all major credit cards, work with many health insurance providers, and offer financing plans.

Take Advantage of Your Savings Before 2023!

ICON Eyecare encourages you to make the most of your FSA, and invest in your eyesight. You can use your savings on a transformative vision correction procedure such as LASIK, CLE, Cataract Surgery, or Visian ICL. Schedule a free consultation with our eye care professionals today to get started!

[DISPLAY_ULTIMATE_SOCIAL_ICONS]